Dr. Yılmaz Argüden, Gizem Argüden Oskay, Dr. Erkin Erimez1

The United Nations Global Compact is a voluntary initiative based on highest level management commitments to implement universal sustainability principles and to undertake and to support UN goals, including the Sustainable Development Goals that were adopted by the world leaders at the UN Sustainable Development Summit in 2015. Research indicates that SDG #16 gets the least focus from corporate leaders.2 The UN Global Compact launched the SDG 16 Business Framework in June 2021 that introduced Transformational Governance to drive responsible business conduct, improve sustainability performance, and strengthen public institutions, laws, and systems.

The authors interpret Transformational Governance as a call to broaden our perspectives on several areas: (1) Mindset on sustainability, (2) Dimensions of impact areas, (3) Time frame and materiality to evaluate the impacts of our decisions, and (4) Scope of our responsibilities.

1. Widening our perspective for a more comprehensive view of sustainability:

Not ESG, but G(EES)3

A sustainable global economy combines long-term profitability with ethical behavior, social justice, and environmental care. When we look at the state of the world today – climate change, deteriorating water resources, plastic waste, income inequality, gender inequality, and corruption – it is evident that institutions need to assume responsibility for sustainable development and act.

For corporations to truly contribute to a sustainable future, we need to widen the lens through which we view sustainability. Sustainability requires decision-making processes incorporating all potential impacts of a company, incorporating the positive and negative externalities into its decision-making processes, and avoiding short-sightedness and selfishness.

This means:

- Adopting a comprehensive view of how a company creates value beyond financial measures to include economic, environmental, and social outcomes throughout the value chain,

- Adopting a long-term perspective and incorporating different time horizons into the strategy and target-setting processes,

- Considering direct and indirect impacts of the company’s decisions and actions,

- Becoming more inclusive by considering the impact of all their decisions and actions on all stakeholders, current and future,

- Taking responsibility for managing and positively influencing their value chain and ecosystem and opening to new ways of collaboration to solve sustainability challenges.

2. Widening our perspective on the dimensions of impact areas4

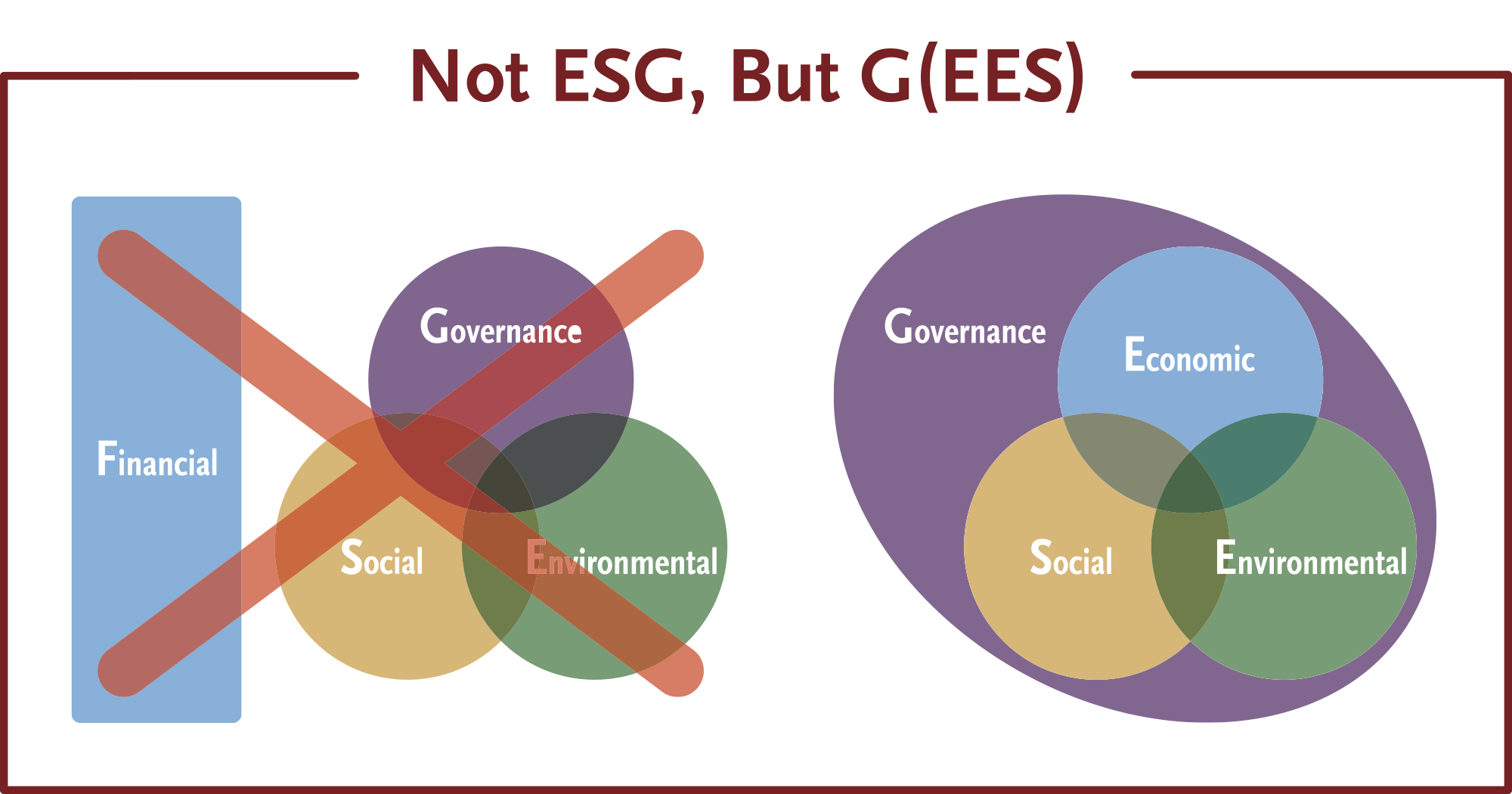

Sustainability is closely linked to the ESG acronym, directing companies to focus on reporting on environmental, social, and governance issues regarding their sustainability impact. However, ESG acronym and reporting has several impediments, and it does not reflect a comprehensive and integrated approach to how companies should approach sustainability. There are two main reasons why ESG reporting is falling short:

a. F (Financial reporting) & ESG (sustainability reporting) division suggests that sustainability is not viewed holistically and fully integrated into the decision-making processes of the company:

- Separating financial reporting from sustainability reporting positions ESG reporting as an adjunct activity. Analysis and management of environmental and social impact should not be considered an adjunct to financial impact but an integral consideration in all decision-making. Since if environmental and social issues are material to the company, they will have an impact on the financials of the company as well. Sustainability reporting should not be limited to ESG but should focus on reporting on the company’s impact across the value chain economy, the environment, and society. Connectivity is key to understanding the interrelation between economic, environmental, and social impacts on the financials of the company.

- Financial reporting typically does not encompass the total economic impact of a company’s operations: A more comprehensive and integrated view of economic impact would include the value chain as well as a broader range of stakeholders, including operating geographies and communities in which the company operates. Internalizing this perspective of managing the impact of our actions would allow companies to look from a wider lens that would enable more innovative and effective solutions to sustainability issues by mobilizing stakeholders and assuming responsibility for transforming their value chain.

b. The G in ESG refers to a limited governance definition; adopting a more comprehensive view of governance can enable more effective management of sustainability:

- The ESG acronym shows a limited view of governance as an additional impact dimension. Rather than a separate impact domain, governance is a framework for providing guidance and oversight over all decisions and actions with economic, environmental, and social impacts. Current reporting practices on governance encompass issues such as anti-corruption, but the more important focus should be how sustainability is governed (the governance of sustainability).

- Labeling G for governance as one of the concepts along with Environment and Social (ESG), does not encompass how we should provide governance to all our decision-making and their implications for Economic (financial outcomes for the company as well as economic development for the whole value chain), Environmental, as well as Social domains. Therefore, the definition of G should be a central, overarching category and requires looking at the whole through an integrated thinking lens.

Therefore, we suggest that a more appropriate acronym would be G(EES), prioritizing the governance of sustainability impacts (economic, environmental, and social impact). This language change would instill a proper understanding of good governance that needs widening our perspective for a more comprehensive view of sustainability.

3. Widening our perspectives on dimensions of time frame, stakeholders, and materiality

Sustainability standards are going through a high paced transformation. In June 2021 the Value Reporting Foundation was established through the merger of SASB and International Integrated Reporting Council. In April 2022, the VRF was consolidated into IFRS Foundation. In June 2023 the IFRS published the Sustainability Standards S1 and S2 that will provide impetus for better focus on evaluating the sustainability issues. However, still the standards are taking the short-term investor focus and materiality is not defined as double materiality.5

However, what is material for our stakeholders becomes material for the company if not attended on a timely basis either as a reputational risk or through regulation. Furthermore, dealing with negative impacts can be managed with much less cost, if they are attended to at the design stage early on, rather than trying to remedy them later. Therefore, lengthening our perspective on time frame would be not only a better prevention, but also an opportunity for value creation.

4. Widening our perspectives for scope of responsibilities

Leadership should involve not only managing your own organization, but also positively influencing the stakeholders in the ecosystem as well as assuming responsibility for improving the business climate. In turn, this will enable companies to not only enhance the resilience of their companies to economic, environmental, and social risks, but also to identify opportunities for innovation and value creation.

Corporate purpose and reputation should drive not only what we do for our own value creation, but also for upholding a positive climate for good governance. Such an approach requires advocacy and lobbying for the good of the society; capacity building throughout the value chain, and collective action and partnerships for improving the state of the world, and inclusive external stakeholder engagement to be able to consider the interests of all concerned.6 7

Sustainability requires an understanding as Yunus Emre, the great Sufi poet and thinker of the 13th century, who preached:

“Regard the other, as you regard yourself,

This is the meaning of the four Holy Books,

If there is any.”

Companies that take sustainability seriously also improve the sustainability of their success. Sustainability of the success of a corporation can only be achieved by adopting a long-term perspective, considering the interests of all stakeholders in decision-making, and having a continuous ability to invest and innovate. Sustainable success can be achieved through integrated thinking (for innovation and sustainability), effective implementation (for value creation and value capture), and proper communication of value creation and value capture models (value reporting for gaining the trust of the stakeholders to gain preferential access to various forms of capital).

Governance of sustainability should be prioritized if we are to drive real change. Governance is providing guidance and oversight to management to ensure the organization’s sustainability by gaining trust of its stakeholders. Therefore, good governance is about creating a climate where a culture for building value and trust is nourished. Good governance must ensure that the organization has the right people, processes, information, and values to create value and build trust.

The future of good governance requires transforming our understanding of the impacts of our decisions and actions by broadening our perspectives in all these areas and ensuring that such a broad understanding of our decisions and actions are incorporated into our governance systems.

Our recommendations to the investors and corporations for adopting transformational governance are:

- To utilize G(EES) instead of ESG as the appropriate acronym for sustainability to help better understanding of the importance of governance,

- To adopt integrated thinking and integrated reporting <IR> to appropriately consider the impacts of corporate decisions on all relevant dimensions for different stakeholders,

- Lengthen the time perspective for evaluating the potential impacts and adopt ‘double materiality’ in evaluating impacts,

- Assume responsibility not only for their own institution, but also for improving the climate of trust in the community through collective action and responsible behavior.

Footnotes

1. This article was originally written for the “COVID-19: Pivoting from Profit to Purpose” panel at the UN Global Compact Leaders’ Summit on 16 June 2020 to support Dr. Yılmaz ARGÜDEN’s proposal to review progress on each SDG on a separate calendar day. In line with this recommendation, to focus on SDG #16 and review progress for motivating peer learning, “Good Governance Day” is being celebrated on February 16th of each year since 2021 under the leadership of UN Global Compact Türkiye. The article was discussed at the Transformational Governance Roundtable in Istanbul on July 12, 2023, and finalized for the UN Global Compact Leaders’ Summit of 2024.

2. “Sustainability Governance Scorecard” prepared annually by the Argüden Governance Academy since 2019 that reviews about 200 Global Sustainability Leaders on how they provide governance to their sustainability efforts and how they embrace Sustainable Development Goals (SDGs). (ISBN: 978-605-2288-07-8, June 2019).

3. Harvard Business Review – Türkiye, April 2022 “For Sustainability Success, Sustainability Needs to be the Responsibility of Boards and CEOs” by Dr. Yılmaz Argüden & Gizem Argüden Oskay.

4. Harvard Business Review – Türkiye, April 2022 “For Sustainability Success, Sustainability Needs to be the Responsibility of Boards and CEOs” by Dr. Yılmaz Argüden & Gizem Argüden Oskay.

5. The concept of “double materiality” refers to how information disclosed by a company can be material both in terms of its implications for the company’s financial value, as well as the company’s impact on the world at large.

6. “Civil Engagement Model: Building Trust through Good Governance”, Argüden Governance Academy Publications No 26-E, September 2024

7. “Sustainable Success Model©”, ARGE Consulting Publications No: 13-E; June 2021 https://arge.com/books/sustainable-success-model.pdf

About the Authors

Dr. Yılmaz Argüden is a strategist, governance expert, advisor, and board member of major public and private institutions, and NGOs. He is the Founder and Chairman of ARGE Consulting, a globally recognized management consulting firm based in Istanbul. ARGE has served as B20 Knowledge Partner (Governance & Sustainability), as EFQM Advisory Organization, and IFRS Integrated Reporting Training Partner. ARGE Consulting is the first Turkish signatory of the UN Global Compact and has been recognized at the European Parliament as one of the best three companies “Shaping the Future” with its commitment to corporate social responsibility.

Gizem Argüden Oskay is managing partner at ARGE Consulting and board member in Argüden Governance Academy. She started her consulting career in McKinsey and has expertise in sustainability, family business governance and transformational change. She has played an active role in the founding and development of Argüden Governance Academy, a non-profit foundation dedicated to improving governance quality across private, public and social sectors, she contributes to the dissemination of good governance culture in institutions, as well as leading research on sustainability governance to accelerate global learning. She has authored articles in Harvard Business Review Türkiye and the British Journal of Business and Governance, as well as a chapter in the book Handbook of Governance.

Dr. Erkin Erimez is a managing partner of ARGE Consulting, conducting and managing projects on boards, board evaluation, governance, integrated reporting, strategy, risk management, and sustainability with Turkish and international companies. He provides recommendations to policy development processes in UN, EU, OECD, Council of Europe, IFC, EBRD, and IFRS. He has served in the B20 task forces since 2015. He is a member of UN Global Compact Türkiye Network, and a member of Tax, Environment, and Financial Markets work streams at TUSIAD – Turkish Industry & Business Association. He is also an Academic Council Member of Argüden Governance Academy.