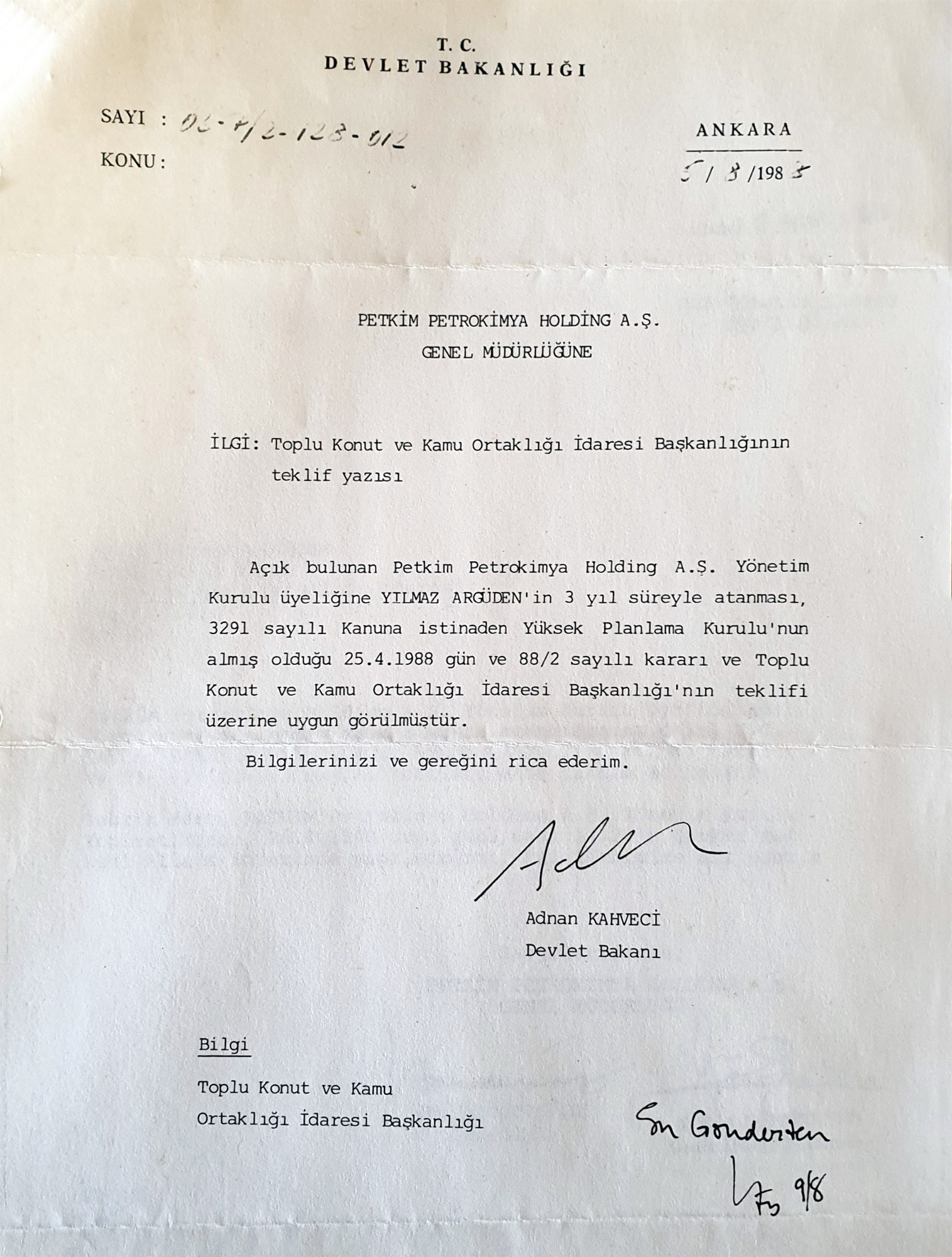

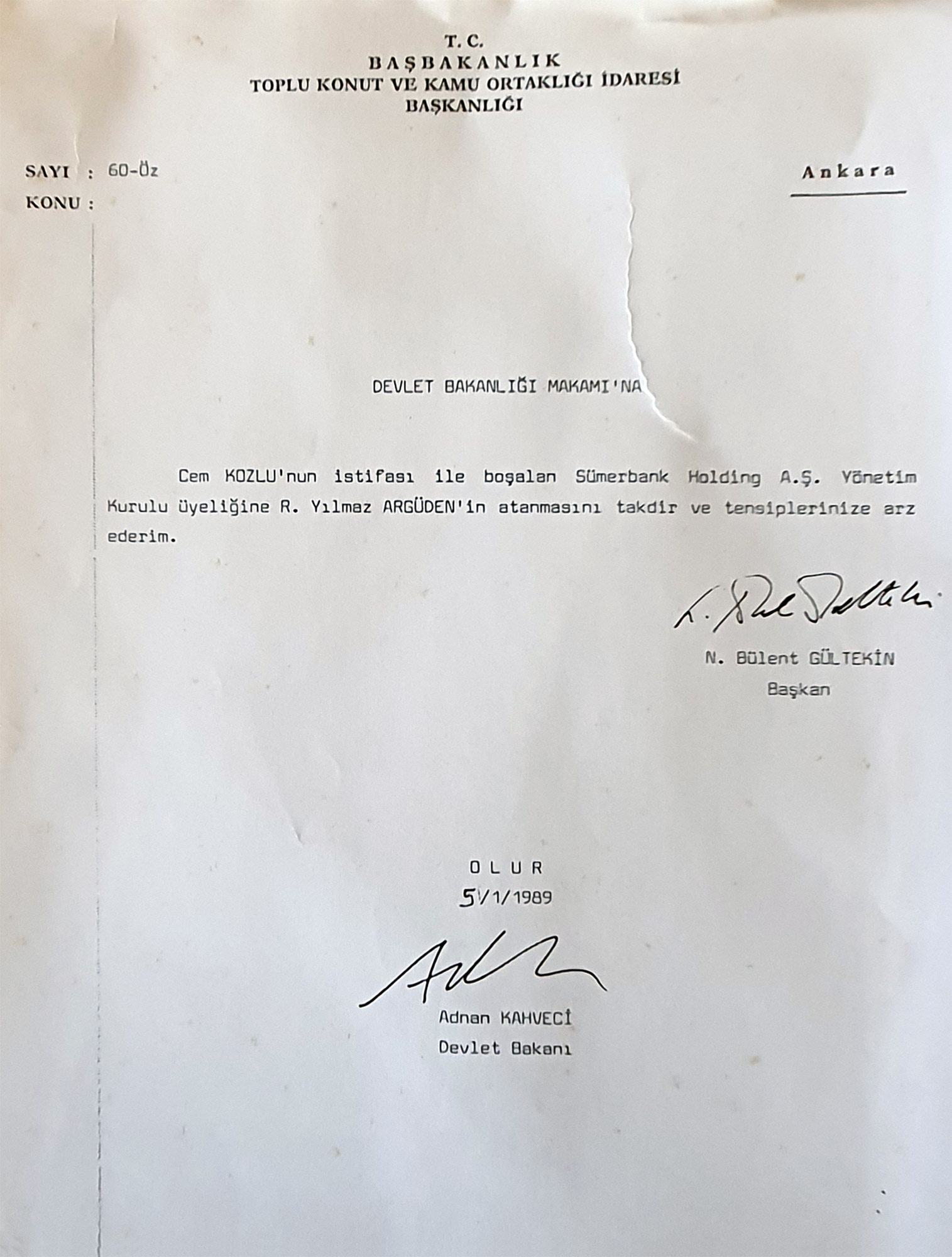

At his Government’s invitation, Dr. Argüden returned to Turkey in 1988 to lead the Privatization Program until 1990. It was during his tenure that the first foreign direct investments were attracted to the Turkish Privatization program, and the public offering of the Government’s shares in industrial enterprises helped the Istanbul Stock Exchange to flourish. In addition, the Turkish buyers improved the competitiveness of the privatized companies, and the Turkish investment banking industry was established.

He demonstrated thought leadership by incorporating the basic principles of anti-cartel regulations into privatization sales agreements, especially in the cement industry, despite the lack of Competition Law in the country at that time.

Quote from Dündar Aytar’s The Story Behind Privatization, 1995

In his book, The Story Behind Privatization, Dündar Aytar relates Dr. Argüden’s invaluable contributions to the contract negotiations for the privatization of the cement industry.

To start with, Aytar underlines that Dr. Argüden had worked at the RAND Corporation, a leading think-tank organization in the US, where he had previously completed his doctoral studies also, and afterwards at the World Bank. Aytar states that Dr. Argüden’s exceptional academic and professional background had been proof for his high potential even before they got to know him personally, and that Dr. Argüden had indeed contributed immensely to the leader of the Privatization Program and his resignation in 1990 had been a irremediable loss.

At a critical point of the negotiations, when anger and exhaustion had overtaken the partcipants, some of whom even attempted to leave the meeting, Dr. Argüden came up with a proposal. An additional amount of 5 million USD had to be paid in order to purchase whole of Soke, and SCF had priced half of Afyon at 7.5 million USD. Taking these into consideration, SCF would have to pay a total amount of 102.5 million USD. Dr. Argüden suggested that the average of 102.5 million dollars and 110 million dollars could be rounded down to 105 million USD, and the Privatization Board could accept SCF to pay 90 million dollars in the first year and the remaining 15 million dollars the next year. .

Hearing this new proposal, Marc asked to make another call. He was smiling when he returned to the table and announced that he accepted this proposal. An important privatization project was thus successfully concluded with the sales agreement made at a good price.